President Dr Mohamed Muizzu has announced a sweeping set of financial reforms intended to stabilise the Maldivian economy, dismantle the US dollar “black” or parallel market, and broaden access to affordable housing.

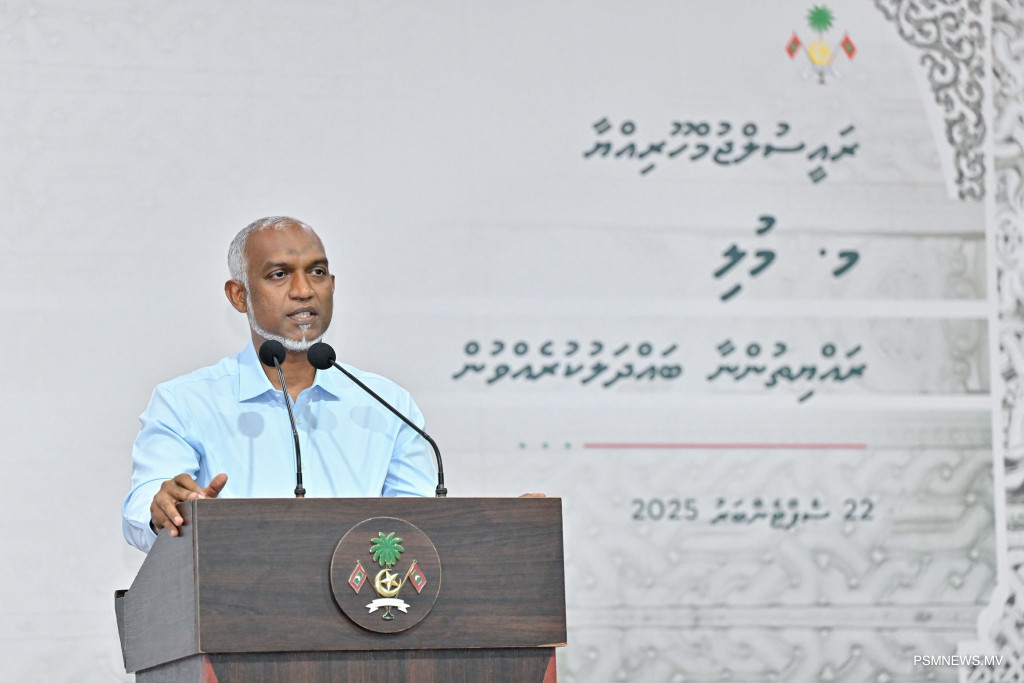

Addressing residents of Muli in the Meemu Atoll, President Muizzu outlined a strategy to increase foreign currency availability and extend long-term housing loans through the national bank. He described the measures as a “rescue from the slavery of the dollar parallel market” and said they were designed to improve the prosperity of Maldivian citizens.

The reforms follow the Foreign Currency Act, which took effect on 1 January and requires certain businesses, particularly in the tourism sector, to convert a portion of their foreign currency earnings through local banks. The president noted that the law has already boosted dollar reserves and increased foreign currency inflows from tourism, easing the nation’s dollar shortage.

Government aims to dismantle dollar parallel market through targeted reforms

From 11 November, the government will introduce measures to improve access to foreign currency. A central element is the installation of US dollar Automated Teller Machines (ATMs) on 40 islands currently without them, with priority given to the country’s seven designated urban centres and islands with developed tourism sectors. President Muizzu also announced the easing of restrictions on overseas transactions through the Bank of Maldives (BML).

“Beginning 11 November, the transaction limit for BML [Bank of Maldives] debit cards used at international Point-of-Sale (POS) terminals will be increased to USD 1,000,” he said. “Effective on the same date, the debit card spending limit for purchasing airline tickets and settling overseas hotel payments will be raised to USD 3,000. Additionally, as of that date, a system will be established to facilitate direct payments from a customer's account to an overseas hospital for medical treatment upon request to the bank.”

To reduce reliance on the US dollar, the government will promote the use of other major currencies in trade and commerce. BML will begin offering accounts denominated in Chinese Yuan, supported by UnionPay debit and credit cards, accepted in more than 180 countries, from 1 January 2026. A similar arrangement is planned for the Indian Rupee, with BML working towards its implementation.

Housing finance programme seeks to ease long-term economic pressures

Alongside currency reforms, the president announced plans to expedite the ‘Hiyavehi’ housing finance programme, aimed at assisting individuals facing financial challenges in building homes on privately owned land. “Loan disbursements to this year's selected applicants will commence very soon,” he said. “Furthermore, the application process for this assistance will be opened for the upcoming year.”

The facility offers favourable terms, including a low profit margin of 5 percent and a repayment period of 25 years. The government has committed USD 64.85 million annually from the national budget to sustain the scheme.

The Bank of Maldives has been tasked with administering and disbursing the funds. Public interest has been strong, with more than 2,200 applications submitted this year. The scheme is divided into three categories: the 'Rahvehi' Scheme, for residents of smaller islands, attracted 1,329 applications; the 'Saharu' Scheme, for residents of designated urban centres, received 586 applications; and the 'Fahi Malé' Scheme, for the Greater Malé region, saw 341 applications.

President Muizzu underscored that these measures, addressing both immediate economic pressures and long-term social welfare, form part of the government’s broader commitment to strengthening the national economy and ensuring the financial security of its people.